You have heard it said that money is the root of all evil: that is incorrect. Money, wealth, possessions themselves are not evil, but the pursuit of these things: greed, spawns evil. For where our treasure lies, here also will be our heart.

What is treasure?

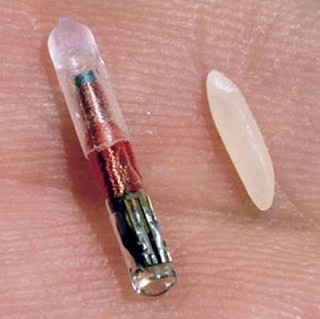

The traditional image of treasure being chests of coins and jewels is a little archaic for a modern discussion of this topic. Today’s treasure tends to be comprised of things like a fat bank account (modern-day equivalent of a chest of coins), a big fancy home, a snazzy car, a killer wardrobe, and all the latest tech toys. When taken individually they may not seem terribly imposing, but when taken en masse they can indicate a problem.

The traditional image of treasure being chests of coins and jewels is a little archaic for a modern discussion of this topic. Today’s treasure tends to be comprised of things like a fat bank account (modern-day equivalent of a chest of coins), a big fancy home, a snazzy car, a killer wardrobe, and all the latest tech toys. When taken individually they may not seem terribly imposing, but when taken en masse they can indicate a problem.

The real question becomes one of want vs need and where your focus lies. Matthew 6 says: Continue reading “Where Your Treasure Lies”

Money is just another tool to be used in bartering with others for what you need. It simplifies the process of life by offering a universally accepted medium of exchange. Instead of trading eggs for flour or firewood for meat, you trade your efforts in your area of expertise for money, then trade the money for the things you need to support yourself and your family.

Money is just another tool to be used in bartering with others for what you need. It simplifies the process of life by offering a universally accepted medium of exchange. Instead of trading eggs for flour or firewood for meat, you trade your efforts in your area of expertise for money, then trade the money for the things you need to support yourself and your family.

© Brigitte A. Thompson, Datamaster Accounting Services, LLC

© Brigitte A. Thompson, Datamaster Accounting Services, LLC